Top Guidelines Of Part C

Table of ContentsThe Best Strategy To Use For Drug PlanThe Main Principles Of Medicare The Best Guide To Parts BSome Known Factual Statements About Part C 4 Simple Techniques For Part C

Medical professionals and also other service providers that accept assignment agree to accept the Medicare-approved amount for a solution. You would be accountable for paying the additional charge (or limiting cost) as well as any kind of copayments.

You need to take Medicare Component A when you are qualified. However, some individuals might not want to look for Medicare Part B (Medical Insurance Policy) when they come to be qualified. You can postpone enrollment in Medicare Part B scot-free if you fit among the complying with groups. If you turn 65, continue to work, and are covered by a company group health insurance, you may desire to postpone signing up in Medicare Part B.

If you turn 65 and are covered under your functioning partner's employer team health insurance, you may desire to delay enlisting in Medicare Component B. Keep in mind: Group health insurance of employers with 20 or more workers have to provide partners of active employees the exact same health benefits no matter age or wellness status.

Medciare Advantage Plan Fundamentals Explained

You will certainly not be enlisting late, so you will certainly not have any fine. If you choose coverage under the employer group health plan and also are still functioning, Medicare will be the "second payer," which means the employer plan pays first. If the employer team wellness strategy does not pay all the patient's expenses, Medicare may pay the entire equilibrium, a portion, or nothing.

If you have severe discomfort, an injury, or an unexpected health problem that you think might create your health and wellness serious threat without prompt care, you have the right to receive emergency situation care. You never ever need previous approval for emergency situation care, and also you may obtain emergency situation care throughout the United States (Drug Plan). http://known.schwenzel.de/2015/hatte-gerade-einen-5-minuten-tinnitus-hrte-sich-exakt-an-wie.

You should request this info. If you inquire on how a Medicare health insurance pays its physicians, after that the plan needs to provide it to you in composing (https://justpaste.it/5us7v). You additionally have a right to understand whether your doctor has a monetary rate of interest in a healthcare center since it might affect the clinical recommendations she or he gives you.

The Part C Diaries

The right to information regarding what is covered and also exactly how much you have to pay. The right to select a females's health professional. The right, if you have a complicated or severe medical condition, to obtain a treatment strategy that consists of direct access to specialists.

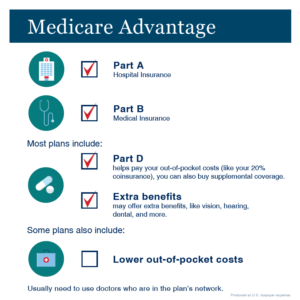

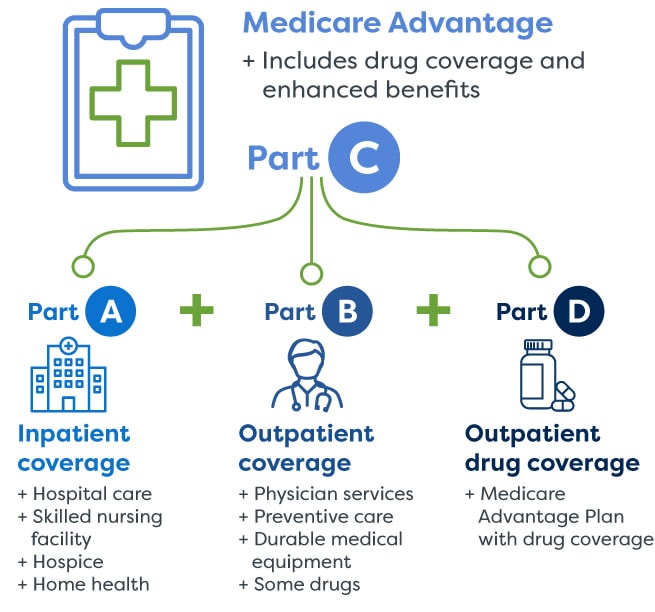

Benefit plans have a tendency to constrict recipients to a limited company network, and protection for details services may not be as robust as it would be with Original Medicare plus extra (Medigap and also stand-alone Component D) coverage. Advantage strategies, consisting of the expense for Medicare Part B, also have a tendency to be less costly than Original Medicare plus a Medigap plan plus a Part D plan.

Where these plans are readily available, it prevails to see them reduce an individual's Component B Social Security premium deduction by $30 to $70 each month, although the costs refunds range from as little as 10 cents monthly to as much as the complete price of the Part B premium.

In that situation, the giveback rebate will be credited to the Social Security examine to balance out the amount that's subtracted for Part B. If those recipients sign up in a Benefit strategy that has a giveback rebate, the amount of the rebate will certainly be reflected on the Part B billing that they receive.

The Ultimate Guide To Parts B

SNPs are required to cover prescriptions. PFFS plans in some cases cover prescriptions, however if you have one that doesn't, you can supplement it with a Medicare Component D strategy. MSAs do not include prescription protection, however you can get a Component D plan to supplement your MSA strategy. Also though Benefit enrollees have rights as well as protections under Medicare guidelines, the services used and also the costs billed by exclusive insurance firms differ widely.

Benefit plans can charge month-to-month costs in addition to the Part B costs, although 59% of 2022 Medicare Benefit plans with integrated Part D protection are "absolutely no premium" strategies. This suggests that recipients only pay the Part B premium (as well as possibly much less than the basic amount, if they choose a strategy with the giveback rebate benefit described above).

This average consists of zero-premium plans and Medicare Advantage intends that don't include Component D protection if we only look at plans that do have premiums as well as that do consist of Part D insurance coverage, the typical costs is higher. Some Advantage strategies have deductibles, others do not. All Medicare Benefit strategies should presently restrict in-network maximum out-of-pocket (not counting prescriptions) to no more than $7,550 - Part C.

PFFS plans sometimes cover prescriptions, but if you have one that doesn't, you can supplement it with a Medicare Part D plan. Even though Benefit enrollees have rights as well as protections under Medicare guidelines, the services provided and the fees charged by personal insurance providers differ extensively.

Rumored Buzz on Parts B

Benefit plans can bill month-to-month premiums in enhancement to the Part B premium, although 59% of 2022 Medicare Advantage prepares with integrated Part D coverage are "zero premium" strategies. This means that recipients just pay the Part B costs (and possibly much less than the conventional amount, if they pick a strategy with the giveback discount advantage defined above).

This ordinary consists of zero-premium strategies and Medicare Benefit intends that don't include Part D protection if we just check out strategies that do have premiums as well as that do consist of Component D coverage, the typical costs is higher. Some Benefit strategies have deductibles, others do not. All Medicare Advantage strategies need to this page presently limit in-network optimum out-of-pocket (not counting prescriptions) to no even more than $7,550.